Tools

Strategy.app provides you with all common strategy tools. Some of them can be applied at different levels, others are level specific.

The basic instruments such as trend analysis or SWOT are available as standard, others can be selected and then appear in the assigned menu.

List of Tools

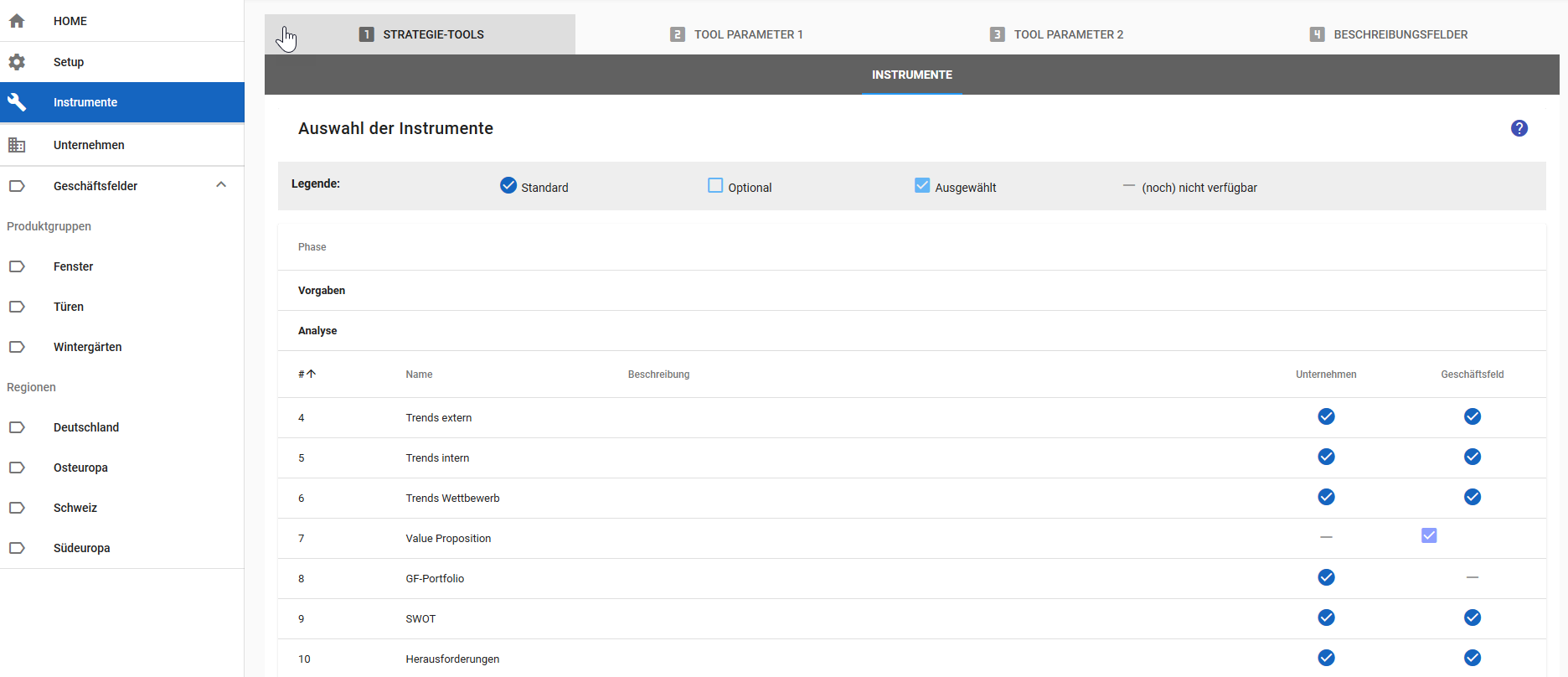

The instruments are marked as follows

| Icon | Meaning | Remark |

|---|---|---|

| standard | the instrument is available by default | |

| optional | the instrument can be selected for the corresponding level | |

| selected | the instrument has been selected for the corresponding level | |

| is not available | the instrument can not be selected for the corresponding level |

The tools can be parameterized to a great extend. For example you can define the characteristics and their valuation for the business segment portfolio. We have prepared a proposal for the parameters for most of the tools. You are free to work with them or adapt them to your needs.

Attention: some parameters can / should not be changed afterwards.

Parameters 1

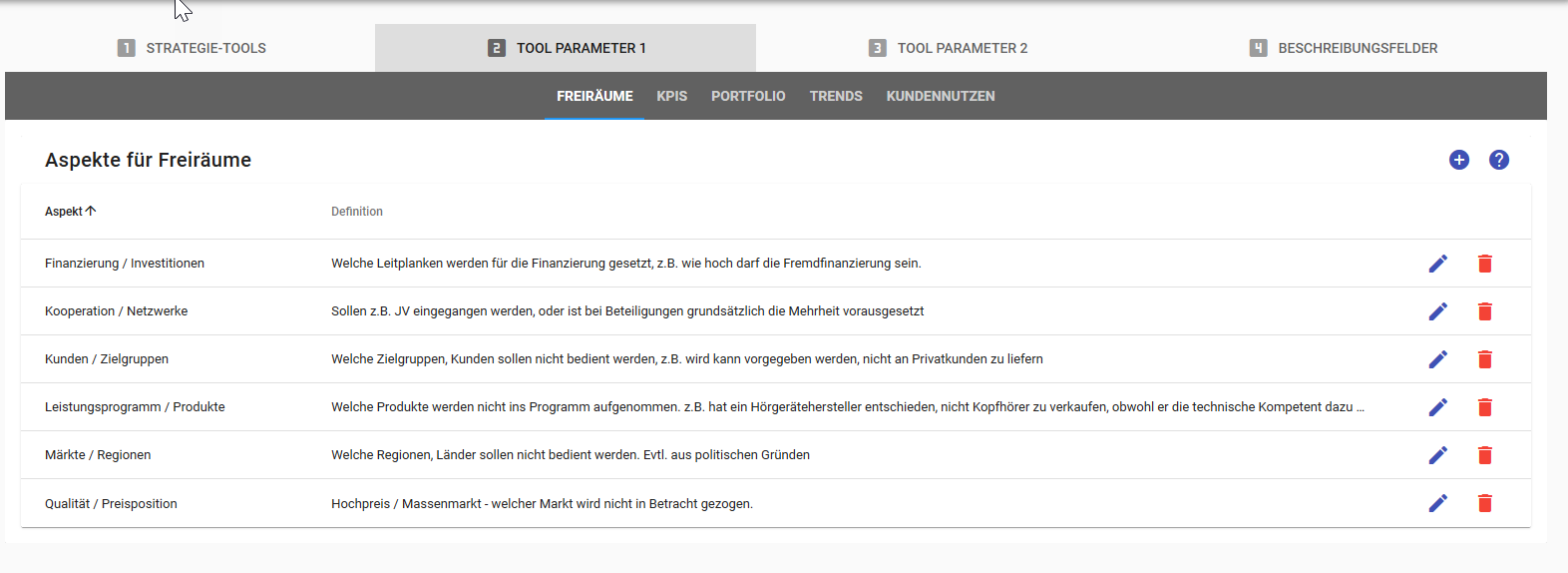

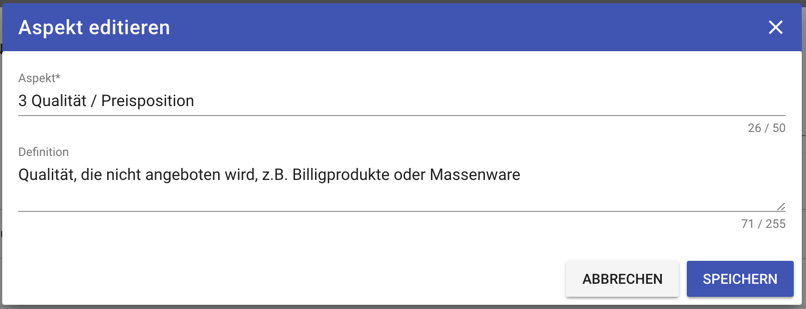

Guideline

(Guard rails for strategy development)

The Guidelines are the playing field for strategy development. Products, customer segments or regions that are out of the question are excluded by guardrails. These guidelines are to be determined by the management or the Board of Directors.

This tool specifies the framework for strategy development. These are mainly topics and options that were explicitly not included in the strategy. These can be products, regions or countries, but also specific market segments. A company producing hearing aids may explicitly state in the strategy that headphones are not manufactured and distributed (as done so, for example, by Sonova).

Here too we have specified a few aspects that can then be adapted as desired:

- Financing / Investment

- Cooperation / Networks

- Customers / target groups

- Services / products

- Markets / Regions

- Quality / Price position

The individual aspects can be supplemented, expanded and adapted as needed:

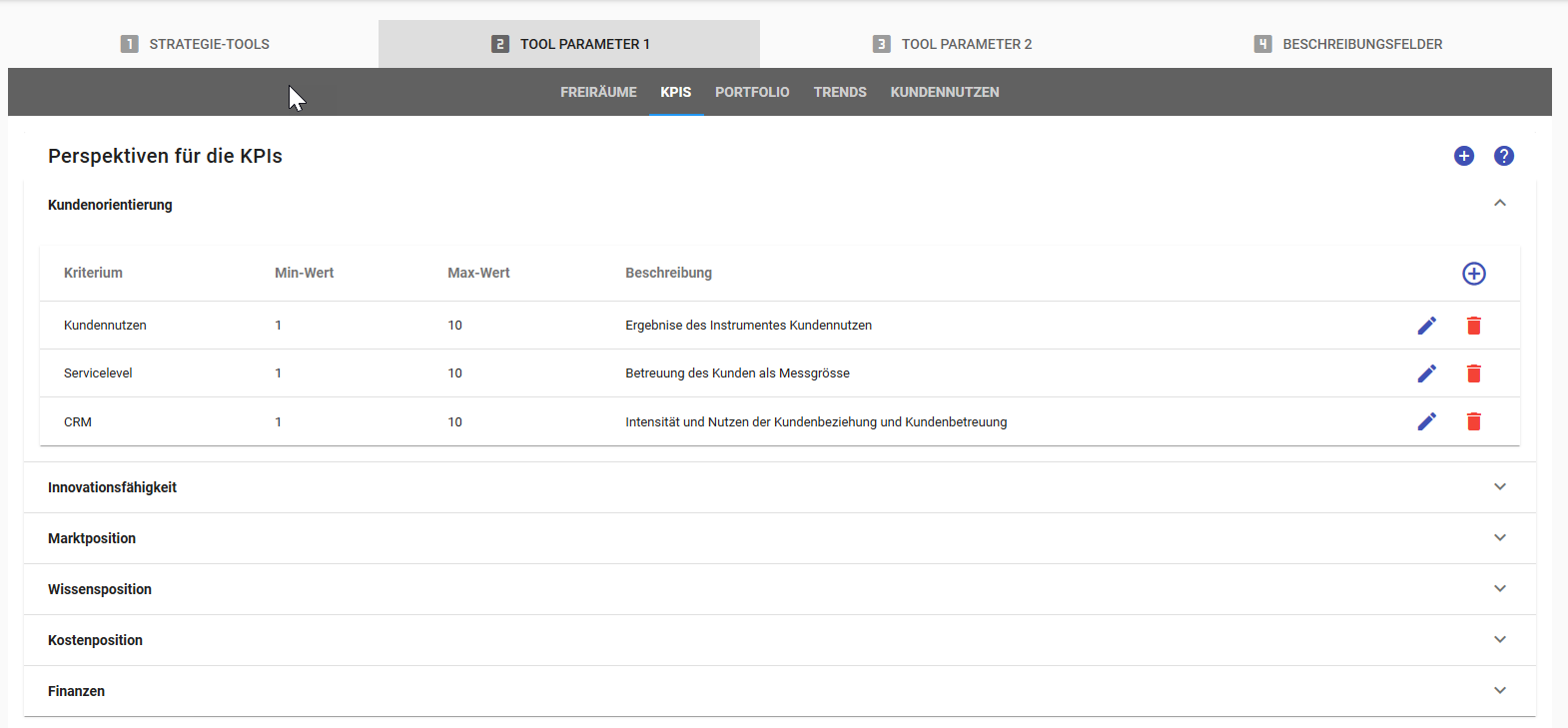

KPIs

(Strategic targets)

Here we are guided by the navigation system of A. Gälweiler, which allows a logical structure of parameters. As strategic KPIs, we set the following dimensions and characteristics:

Customer Orientation

- Customer Value (see also the instrument Customer Value / Value Proposition)

- Service level

- CRM

Innovation Capacity

- Share of new products (new over a period of 3 years - to be determined individually)

- Number of patents

- Development expenditure in relation to sales

Market Position

- Absolute market share

- Relative market share

- Regional presence

- Image

Knowledge Position

- Knowledge of employees (number of professionals, experience)

- Knowledge of the organization (number of meetings)

Cost Position

- Productivity of work

- Productivity of knowledge

- Productivity of capital (return on investment)

These parameters can be changed and / or supplemented as needed. Alternatively, you can also use the Balance Score Card as the basis for the KPIs. The relationship between these KPIs and the Balanced Score Card is easy to see:

| Gälweiler | BSC |

|---|---|

| Knowledge Position | Employee, potential, or learning and growth perspective |

| Cost Position | Interne Growth perspective |

| Customer Orientation | Customer perspective |

| Finances | Financial perspective |

These perspectives can then also be presented in the form of the BSC. Again, the user is free to adjust the perspectives and target variables according to his needs.

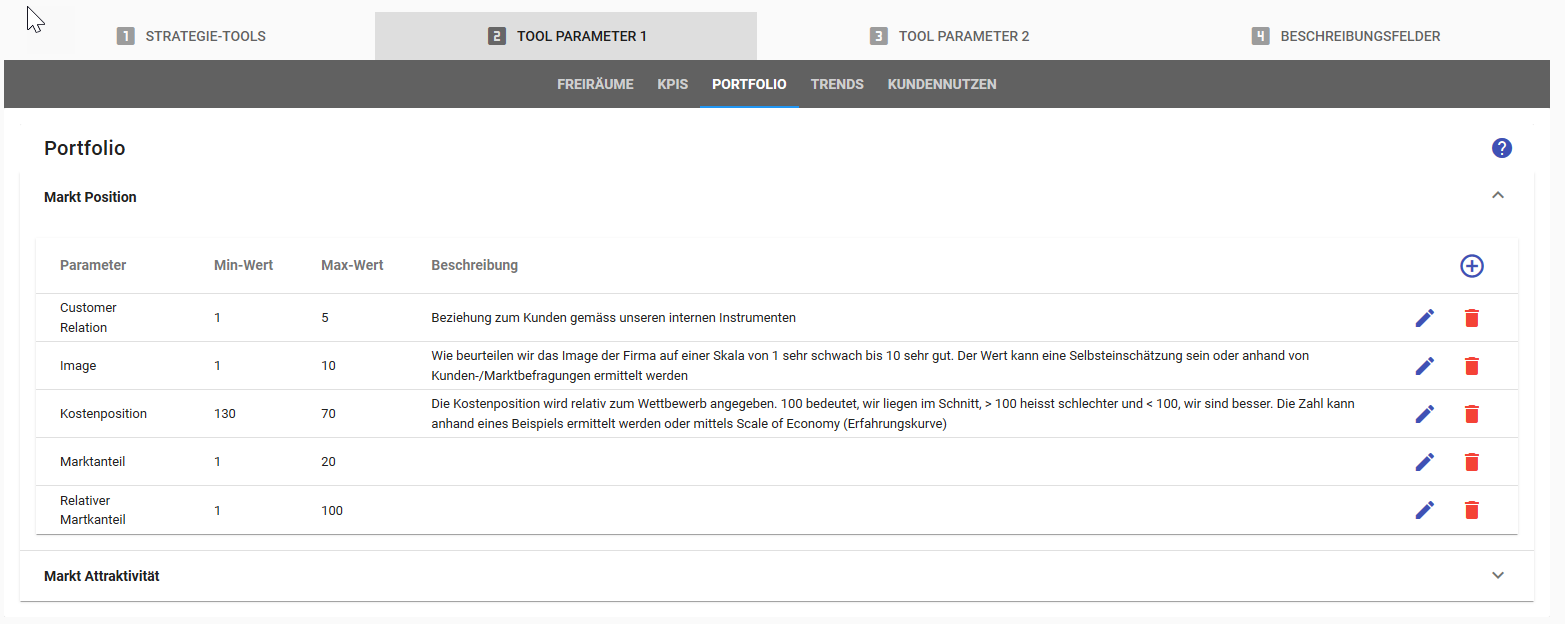

Portfolio

The parameters for the business portfolio are given in two dimensions (categories) and four values each. The dimensions are fixed and can not be changed. The characteristics can be adapted and extended. Likewise, the calculation per category can be specified.

Definition of the given parameters:

Market attractiveness (horizontal axis):

Market volume: The sales achieved by all competitors in this market together.

Market growth: The increase or decrease of the market volume per year in %

Competition intensity: Intensity of the market represented as the sum of the market shares of the three largest competitors.

Price Sensitivity: How sensitive is the market to prices. In general, mature markets are more price-sensitive.

Market position (vertical axes):

Absolute market share: Share of market volume in units or in sales, expressed in %.

Relative market share: The sales of our company divided by the sum of the sales of our three largest competitors.

Cost item: Cost level for the manufacture of the products and / or services compared to the competitors. 100% is taken as an average. If we are 10% lower, this gives the value 90%, higher costs result in a value over 100.

Customer loyalty: To what extent is the existing customer inclined to buy from us next time? On the one hand, this can be pure customer loyalty, on the other hand, it can also be the result of a changeover to other competitors triggering additional investments. One example is maintenance or maintenance contracts, but also intensive networking of the value chain.

Image: Our image with the customer and / or the non-customer. In general, an assessment that is the result of a neutral survey.

Example of calculating the relative market share:

| absolute | our revenue | competitor 1 | competitor 2 | competitor 3 | calculation | result |

|---|---|---|---|---|---|---|

| Sample 1 | 2.000 | 2.000 | 2.000 | 2.000 | 2.000 / 6.000 | 0,33 |

| Sample 2 | 2.000 | 500 | 500 | 500 | 2.000 / 1.500 | 1,33 |

The relative market share can also be calculated on the basis of absolute market shares:

| in % | our revenue | competitor 1 | competitor 2 | competitor 3 | calculation | result |

|---|---|---|---|---|---|---|

| Sample 1 | 20% | 20% | 20% | 20% | 20% / 60% | 0,33 |

| Sample 2 | 20% | 5% | 5% | 5% | 20% / 15% | 1,33 |

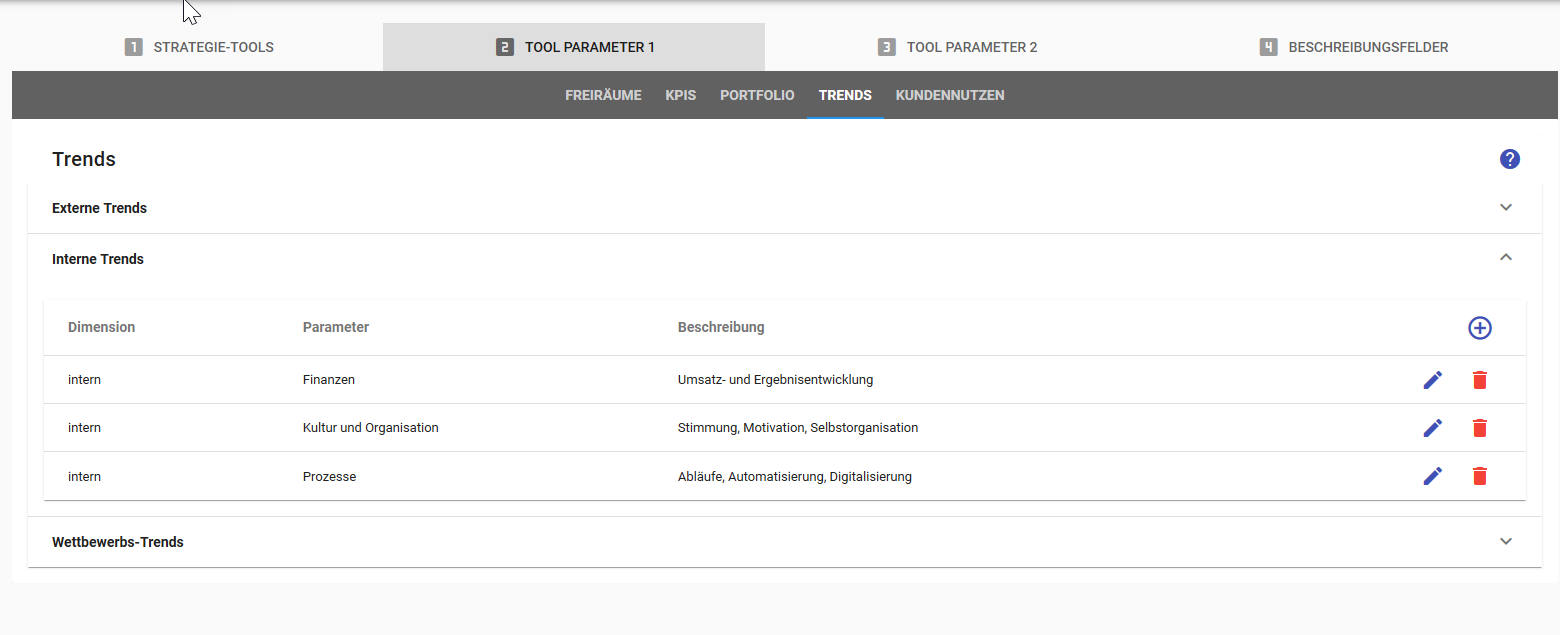

Trends

The trends are divided into three groups

- external trends: Trend in the environment, which are strategically relevant for the company

- internal trends: developments within the company that are strategically relevant

- competition: developments and circumstances in the competitive environment that can / will affect the company

For all three categories, we have included two or three suggestions as standard. These can be customized, supplemented or deleted according to the needs of your company. It is recommended to make these adjustments at the beginning. Once trends have been assigned, the corresponding characteristics can no longer be deleted.

Recommendation

Do not specify more than 3 values per group.

External Trends

This tool captures and describes all identifiable developments that can influence the environment and, above all, the target market over the strategic planning period. The focus is on identifying opportunities and threats to the development of the company, even in comparison with its main competitors. From these trends, opportunities and threats are derived, which then flow into the SWOT.

Internal Trends

The internal trends refer to the developments and situations within the company that are relevant for the strategic planning period. The focus here is on the strengths and weaknesses of the company, also in comparison with its main competitors. The derived strengths and weaknesses are taken up by the SWOT.

Competition trends

Here we list the developments that relate specifically to the main competitors. These can result in strengths, weaknesses, opportunities and threats that are summarized in the SWOT.

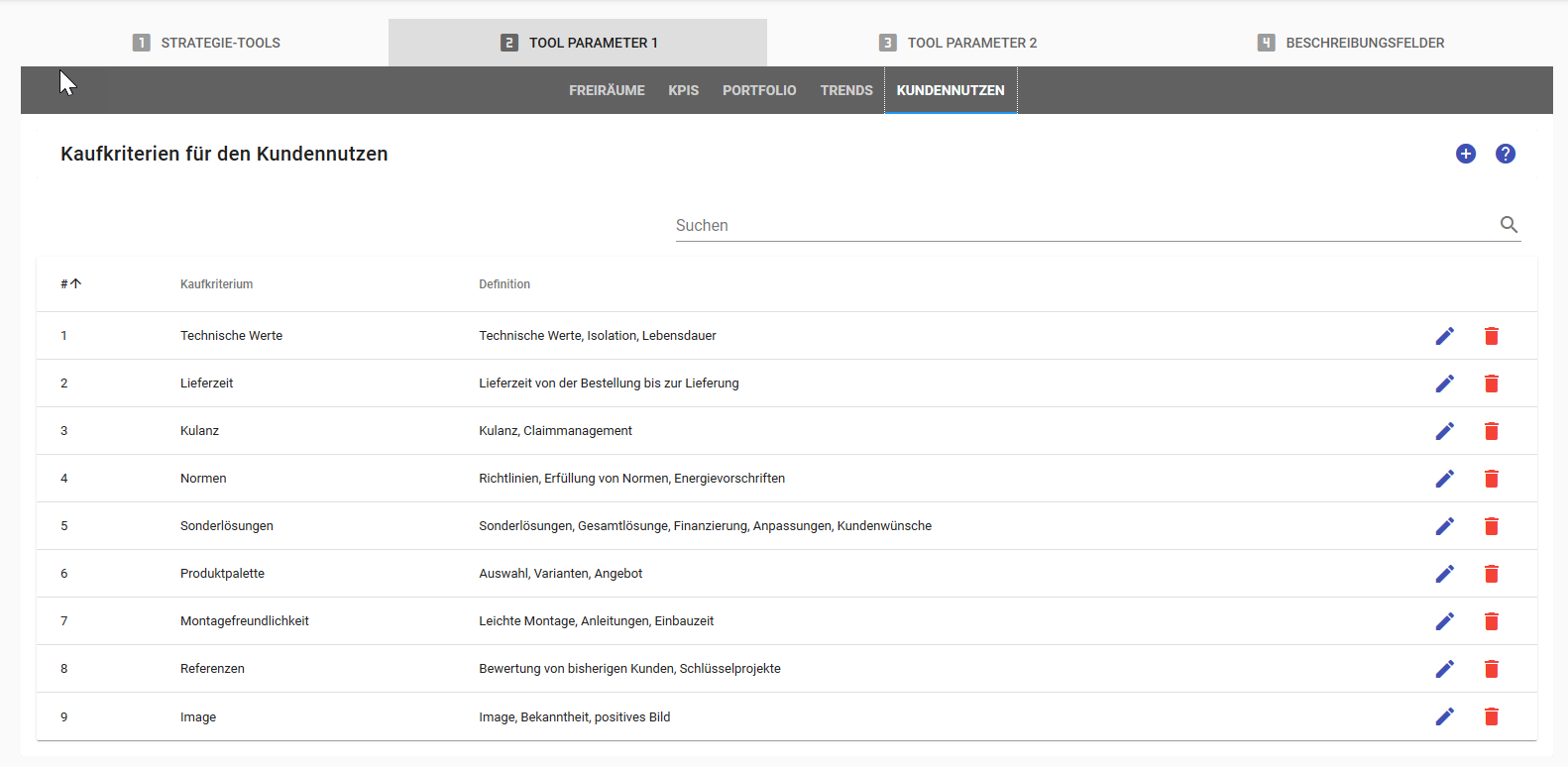

Customer Value

The Cutomer Value is the ratio of relative price to the value proposition of a product or service and includes all influencing factors that influence the purchase decision of a customer. The relative price is the own price compared to that of the main competitors. The value proposition is measured from the perspective of the customer on the basis of the purchasing-critical product and service features compared to the most important competitors.

Didactically, the "Cutomer Value" is the best instrument for aligning and focusing the employees and the company in their activities on the customer's benefit. With this tool can be worked out, where we must differentiate ourselves, so that the customer puts his money on our table and not with the competitor.

Set the purchase criteria

For the instrument customer benefit, we recommend that you define the purchase criteria uniformly throughout the company. This makes the evaluations and results comparable and manages to define the criteria uniformly so that everyone understands the same.

You can define, add and delete these criteria as required (only delete them if they are not already used). Try to make the description or definition clear.

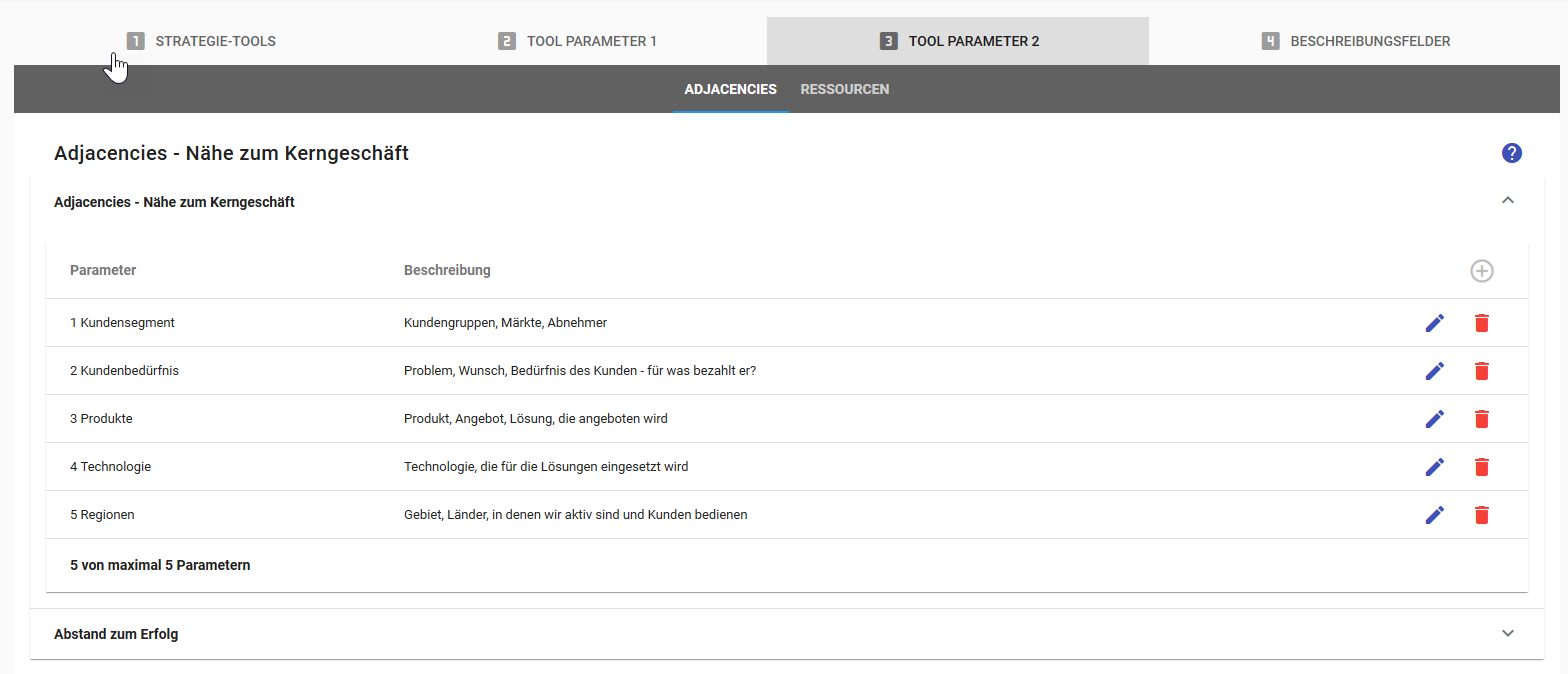

Parameters 2

In this group, the parameters are set for the tools adjacencies and measures as well as for the resources of the strategic directions.

Adjacencies

The Adjacencies method is based on the same philosophy as the Ansoff matrix, but uses several dimensions. While the Ansoff matrix works with the dimensions product and market, additional dimensions are added in the Adjacencies method, e.g. Technology, sales channel, regions, value chain, applications and others.

With this instrument, the strategic options are evaluated according to the dimensions Distance to success and Distance to the core business.

The parameters for the instrument Adjacencies again consists of two levels: the dimension and the criteria. The vertical dimension is the distance to the core business

- called Adjacencies, and the horizontal axis shows the Distance to success A maximum of five occurrences can be defined per dimension.

We give the following parameters at the beginning:

* Adjacencies*

- Customer

- Customer problem

- Products

- Regions

- Technologies

* Distance to Success*

- Investment

- Duration until first sale

- There is already a market today

- Building know-how

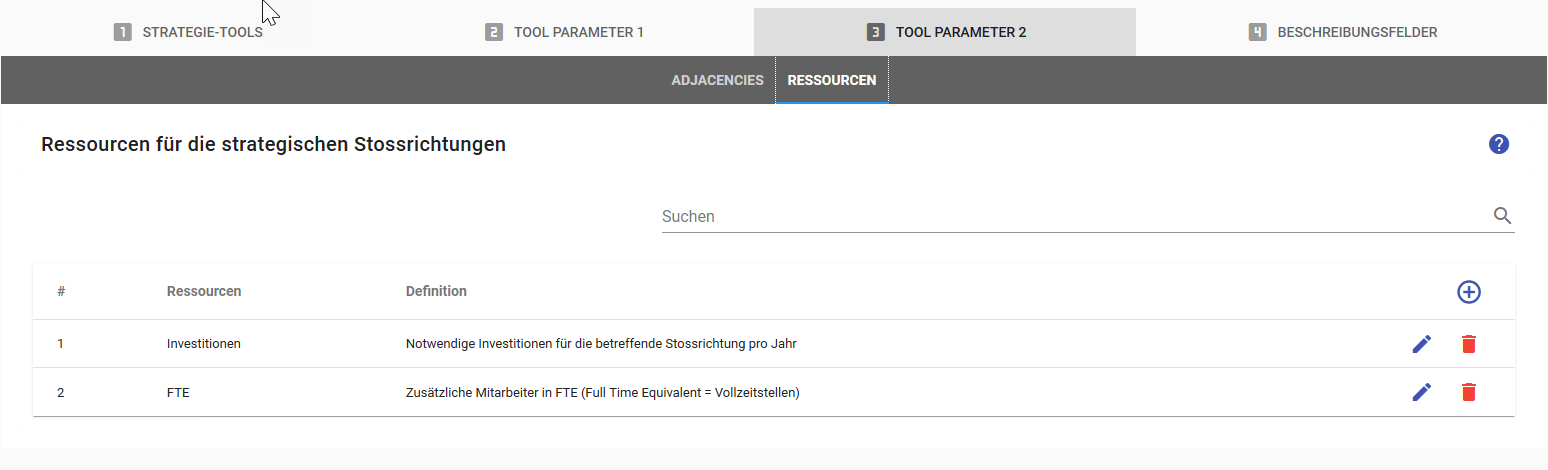

Resources

The strategic directions are assigned to two groups of parameters:

- the CM -> these come from the specification of the chart of accounts

- the resources -> this concerns e.g. the investments necessary to implement a strategic direction

These resources are set here. The following are specified:

- Investment

- Number of additional employees (FTEs)

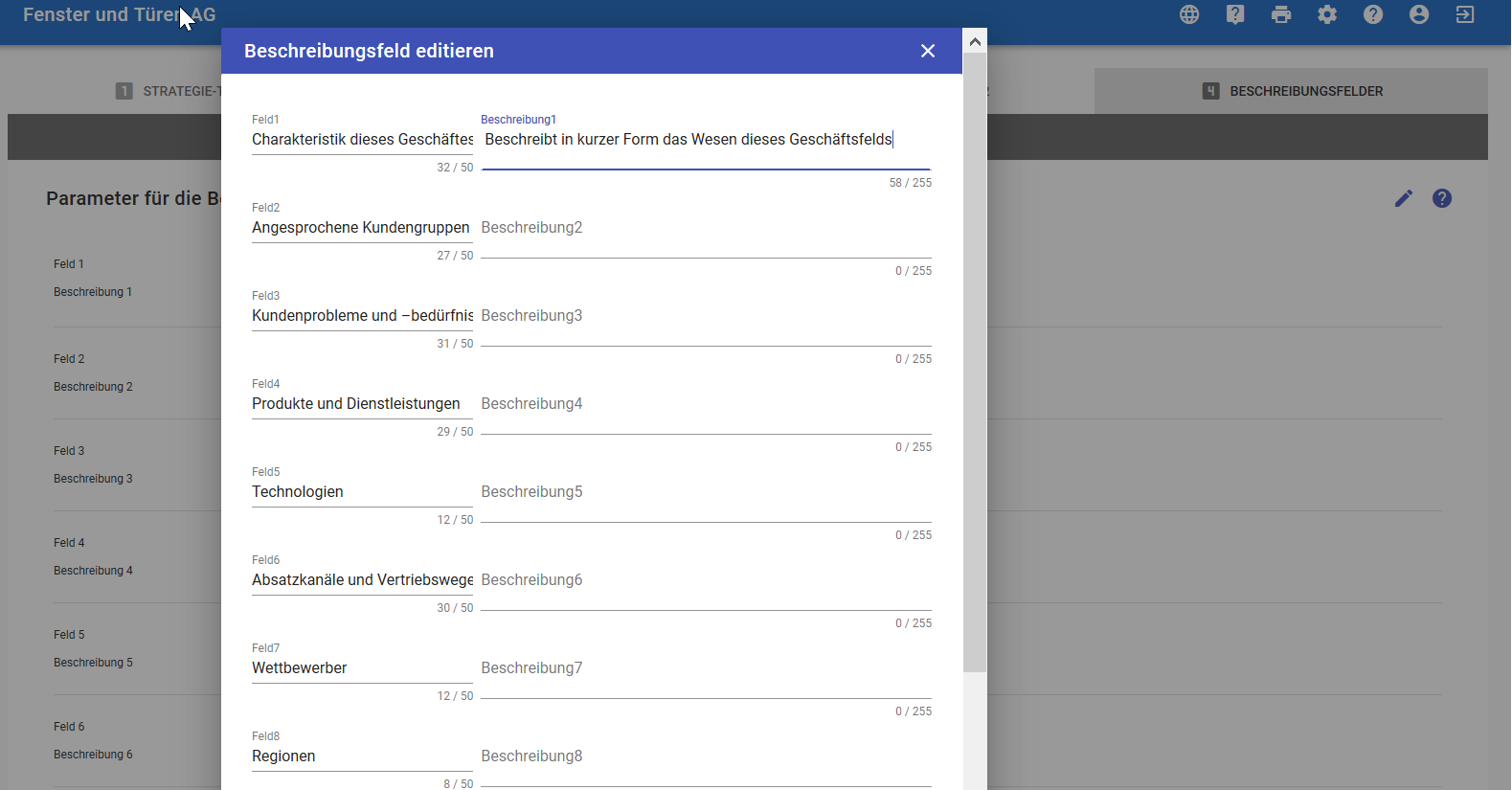

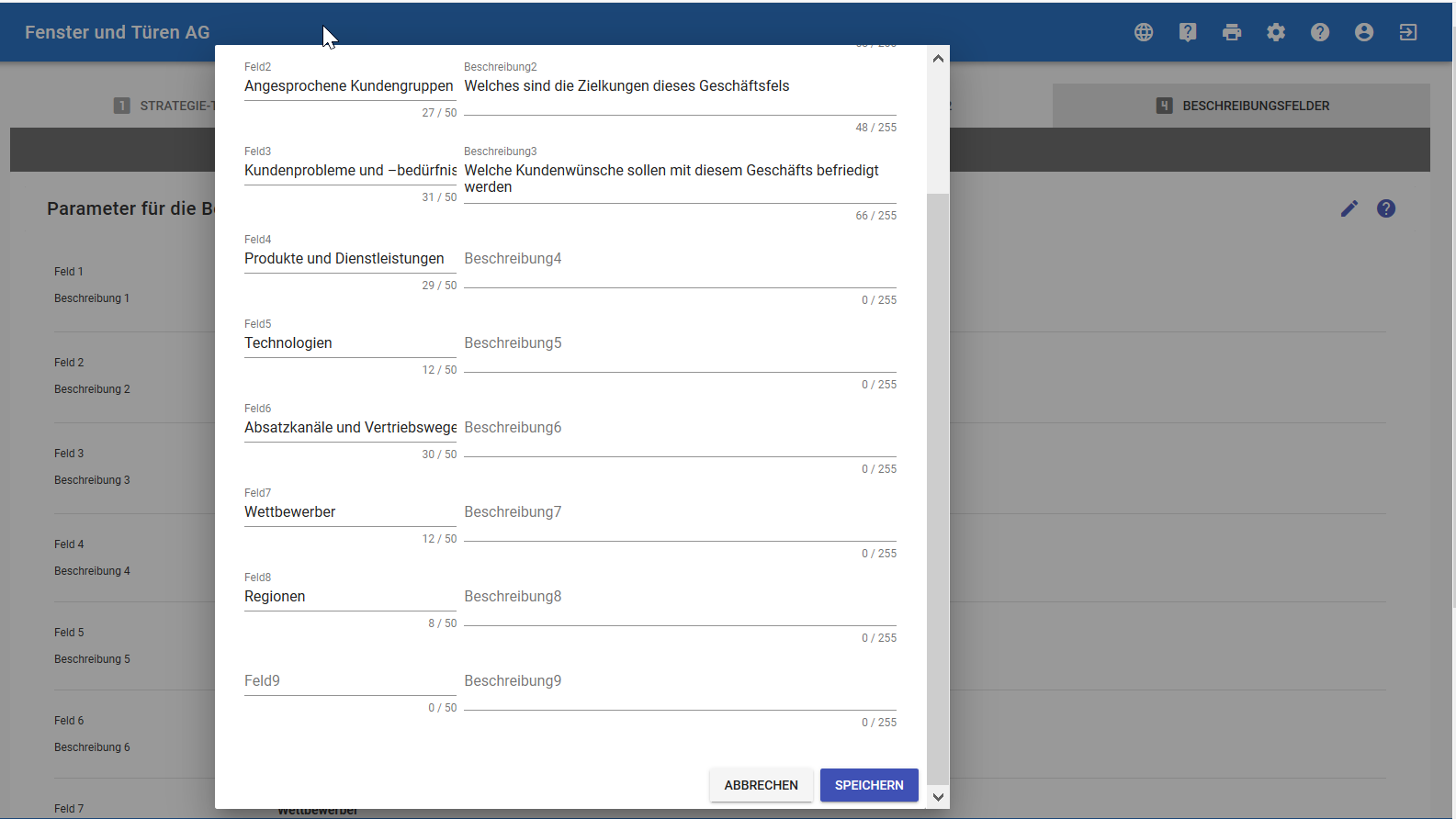

Description Fields

These parameters help you to customize your descriptions for the business units, for the competitors and the strategic directions according to the needs of your company. No more can be added and the existing ones are always used in the same place

Business Units

For the business fields we have the following values for you:

- Characteristic of this business

- Addressed customer groups

- Customer problems and needs

- Products and services

- Technologies

- Sales channels and distribution channels

- Competitors

- Regions

- is empty at the moment

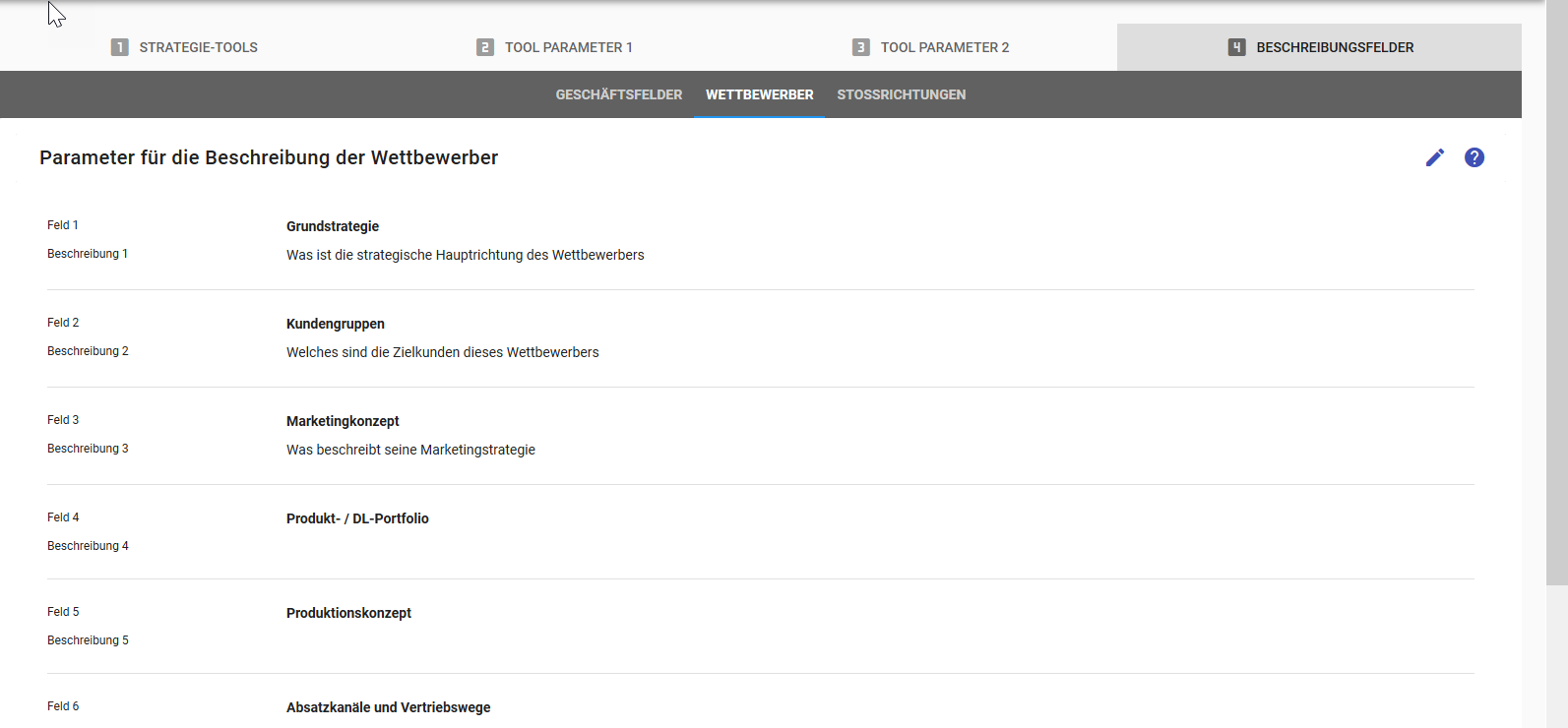

Competitors

For the competitors we have the following values for you:

- Basic strategy

- Customer groups

- Marketing concept

- Product / DL portfolio

- Production concept

- Sales channels and distribution channels

- Core skills

- Regions

- is empty at the moment

Strategic Directions

For the strategic directions we have the following values for you:

- Description

- Market segments / customer groups

- Market stimulation: price-quality

- Complementary services

- Sales Channels / Sales

- Marketing / Communication

- Cooperation / suppliers

- Functional requirements

- is empty at the moment

← Setup Company Level →